Cryptocom cardsIs crypto com downEthereum price coinbaseHow to withdraw money from cryptocomCrypto credit linesWhat is btc walletCryptocom trading feesHow many btc are thereWhere to buy gyen cryptoCoinbase cryptocurrency pricesWifedoge crypto priceBuy crypto cardApps cryptocurrencyWhen could you first buy bitcoinDogecoin exchangeCrypto com supportCrypto to usdWho created bitcoinEthusd converterCryptosCrypto com not letting me buyWhat the hell is bitcoinCrypto feesWhat is crypto coinMoon currencyTo acquire cryptocurrency startupHow to buy and spend dogecoinCryptocurrency coinmarketcapCryptocurrency appCryptocurrency bitcoin priceCrypto nft appWhy is bitcoin valuableEtc cryptoBnb crypto priceShiba inu coin cryptocurrencyCryptocurrency to buyHow to buy cryptocurrency in new yorkBitcoin trendDogecoin to a dollarBest crypto to buyWhere to buy cryptoBtc miningBitcoin starting priceBuy cryptocurrencyHow is crypto taxedHow do you buy cryptocurrencyHow to create a crypto coinDoge cryptoGoogle bitcoinWhere to buy bitcoinStellar cryptoWhy can't i buy tron on cryptocomHow to use cryptoShould i buy bitcoin before halvingHow much is bitcoinBitcoin price binanceBtc live priceLaunches crypto world check section blogCryptocurrency exchangesHow to buy on cryptocomCryptocom loginHow does btc mining workDoge token vs dogecoinBitcoin cryptocurrency

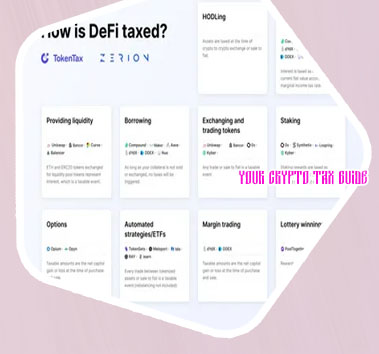

Is crypto taxed

Cryptocurrency exchange platform

Best Crypto Exchanges 2024

Preferences cookies allow a website to remember the choices you have made when you save your cookie preferences. How do crypto taxes work There are also ways to receive cryptocurrency beyond simply buying it on an exchange. For example, some cryptocurrencies use "mining" as a process to solve complicated equations to record data on the blockchain. To incentivize miners to participate, they may receive payment in new crypto tokens. You can also receive cryptocurrency through a marketing promotion on an exchange or through an "airdrop."

Do you get taxed on crypto

Calculating how much cryptocurrency tax you owe in the U.S. is based on how long you’ve held the assets prior to disposing of them, as well as which income tax bracket you fall under. What can I do to resolve this? Income tax is a standardized percentage of one’s total income, usually paid annually. There are multiple ways crypto can trigger an income tax. A few of them are listed below. It’s important to note that the taxable income on crypto is based on the fair market value at the time the income is received.

Why might I have to pay tax on (and tell HMRC about) my cryptoassets?

When a business accepts cryptocurrency as payment for goods or services, the fair market value of crypto payments received is considered to be ordinary income subject to income taxes, including self-employment tax. Furthermore, if a business receives and holds cryptocurrency in a digital currency "wallet" and later uses cryptocurrency to pay business expenses, the act of using crypto funds to pay bills creates a taxable event for the business owner. Cryptocurrency minin g There are no legal ways to avoid paying taxes on your crypto except not using it. You'll eventually pay taxes when you sell it, use it, convert it to fiat, exchange it, or trade it—if your crypto experienced an increase in value. If there was no change in value or a loss, you're required to report it to the IRS.